IG ASIA Announces Robust PEA for Pribrezhniy Copper Project with NPV8 of US$2.09 Billion and Confirms Significant New Porphyry Discoveries Outside Main Deposit

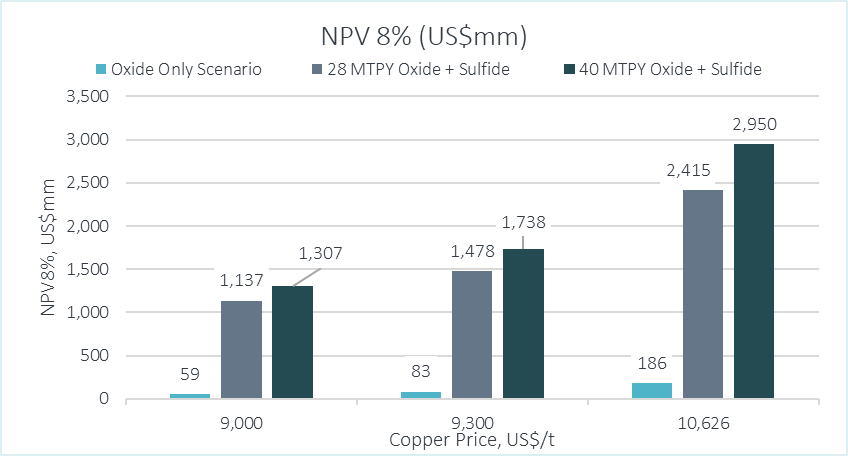

/EIN News/ -- CHARLESTOWN, St Kitts and Nevis, Jan. 30, 2025 (GLOBE NEWSWIRE) -- IG ASIA LLC ("IG Asia" or the "Company") a private company based in The Nevis, is pleased to announce the results of an independent Preliminary Economic Assessment ("PEA") for its 75%-owned Pribrezhniy Copper Project ("Pribrezhniy" or the "Project") in Kazakhstan. The PEA, completed by J T Boyd Company, evaluates three development scenarios including a stand-alone oxide operation and two combined oxide-sulfide scenarios that demonstrate robust project economics with after-tax NPV8 values ranging from US$59 million (oxide-only base case) to US$2.95 billion (combined optimistic case). Additionally, recent exploration has confirmed significant new porphyry copper-molybdenum-gold discoveries outside the main deposit area, highlighting substantial resource growth potential.

PEA HIGHLIGHTS

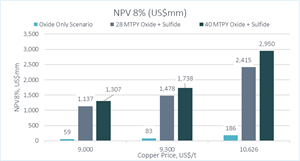

• Three development scenarios evaluated, all demonstrating positive economics:

- Scenario 1 (Oxide Only): NPV8 range of $59M-$186M (depending on price deck*), IRR base case of 16%, initial CAPEX of $142M.

- Scenario 2 (28Mtpa Combined): NPV8 range of $1.14B-$2.42B (depending on price deck*), IRR base case of 18%, initial CAPEX of $1.43B.

- Scenario 3 (40Mtpa Combined): NPV8 range of $1.31B-$2.95B (depending on price deck*), IRR base case of 16%, initial CAPEX of $1.85B.

* price deck assumptions, USD9,000/t Cu base case; USD9,300/t Cu optimistic; USD10,626/t Cu spot price as of May 27 2024, after confirmation of MRE.

• Pribrezhniy Deposit Resource Base:

- Inferred Sulphide Resource of 1.38Bt @ 0.37% CuEq.

- Inferred Oxide Resource of 31.5Mt @ 0.39% Cu, potentially amenable to heap leaching.

- Resources remain open at depth and along strike of controlling structures north, south and west.

• Processing Options:

- Stand-alone oxide SX/EW operation producing up to 20,000 tpa copper cathode.

- Combined ‘dovetailing’ operation processing both oxide and sulfide mineralization.

- Conventional sulfide flotation producing copper and molybdenum concentrates with Ag/Re/Se credits.

The PEA was instigated in Q3 2024 on the back of successful due diligence of the project to bring all technical disciplines together and test the economic viability of the project in more detail and fully assess the risks in the modifying factors to the economic analysis. The assessment included a maiden resource estimate calculated by Wardell-Armstrong International.

PROJECT OVERVIEW

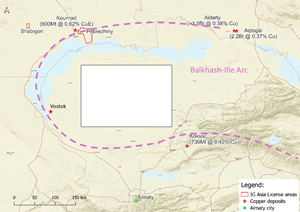

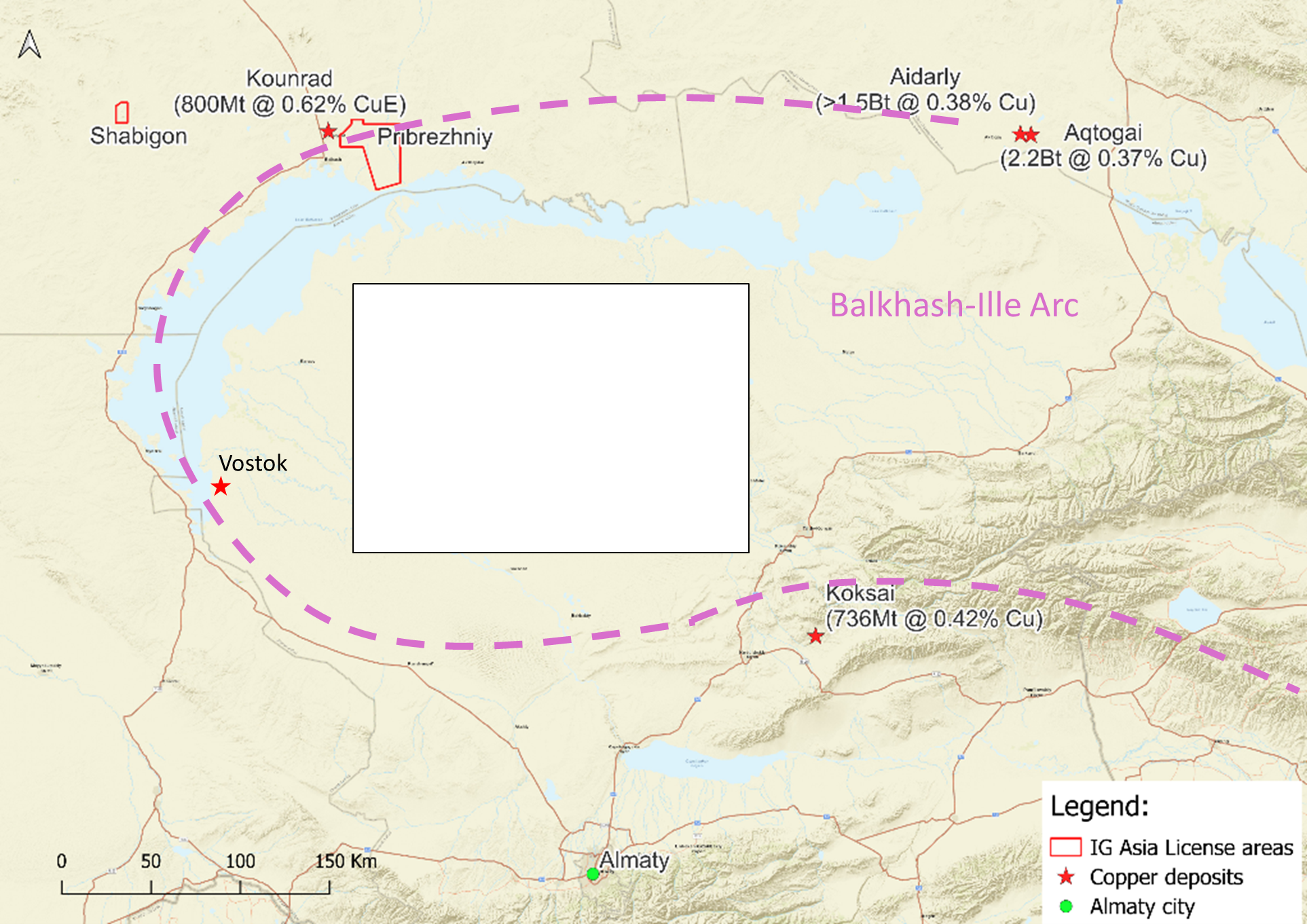

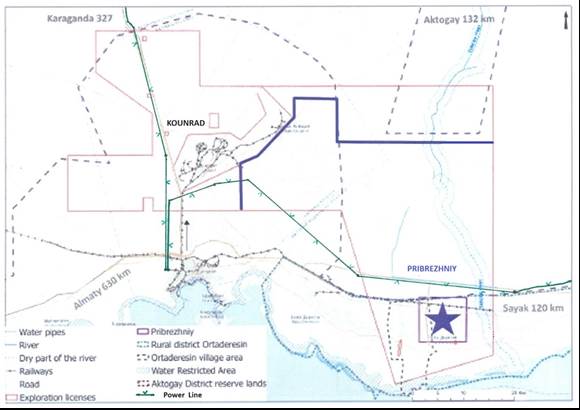

The Pribrezhniy Project is located in Kazakhstan's highly fertile central porphyry copper play, the “Balkhash-Ille” arc (Figure 1), 370km south of Karaganda and 35km southeast of Balkhash. The Project's 754 km² license area is valid until February 2029 and sits within the same structural corridor as the historical Kounrad Mine, which produced approximately 800Mt @ 0.62% Cu until 1996.

Figure 1: Large porphyry copper ±Mo/Au occurrences along the Balkhash-Ille Arc

In October 2024 IG Asia completed the acquisition of a 75% majority interest in the Balkhash-Saryshagan Partnership (“The Pribrezhniy Project” or “Project”) from Rio Tinto International Holdings Limited. The Project license area covers 754 km2 of exploration ground with the exploration stage of the license being valid until February 2029 (See May 1, 2024 here.)

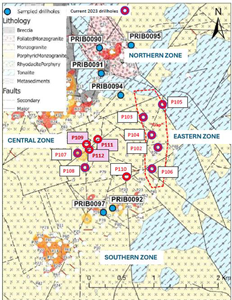

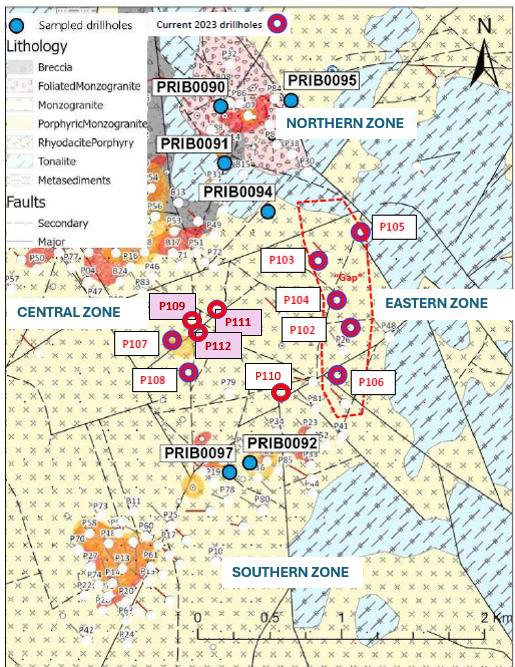

At deposit scale monzonite and granodiorite form the main host rocks intruding an earlier phase of tonalite (“quartz diorite”). The main mineralization age was determined as 329 Ma and is divided into four zones, North, East, South and Central – Figure 2. The western zone is underexplored and prospective.

Oxide mineralization lies immediately below the alluvial cover and is widespread across both northern and southern zones (RTX 2022 inventory of 55Mt @ 0.31% Cu, 168,000t in situ contained Cu at 0.2% Cu cut-off grade). Oxide mineralization is represented by malachite, chrysocolla, copper-bearing smectite, copper-bearing vermiculite, cupriferous biotite and copper-bearing goethite.

Sulphide mineralization is represented by quartz-chalcopyrite, quartz- chalcopyrite-molybdenite D-veinlets with intense sericite changes in the wall rock (Figure 3). The veinlet mineralization is structurally controlled by a network of fine fractures with a main dip direction of ~70o to 125 degrees. Disseminated mineralization is not common. Streaky molybdenite with quartz is also noted in the south. In the northern zone, thick quartz-chalcopyrite veins were noted filling tensional voids in the matrix of tectonic breccia. Brecciation forms an important mineralizing event responsible for some of the highest Cu grades including localized development of net-textured and massive sulphide.

Figure 2: Property-scale geology of Pribrezhniy with latest diamond drillholes at the end of yearly campaigns for 2022 (blue) 2023 (red donuts).

Figure 3: Drillhole PRIB106, 168m depth. Quartz-chalcopyrite D-type vein with sericite selvage in wallrock cutting rejuvenated A-veins with K-feldspar in granodiorite.

DEVELOPMENT SCENARIOS

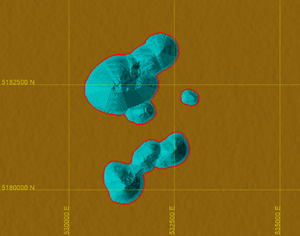

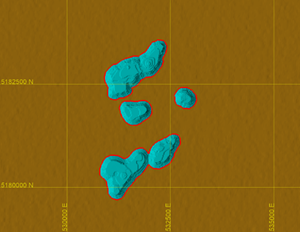

Scenario 1: Fast-Track Oxide Operation, conventional open pit (Figure 4a) scheduled for minimal initial capital and shortest time to generate cashflow;

• Potential for Initial 10,000tpa copper cathode production for first 3 years with low initial capital requirement of $75M to start up.

• Strip ratio of <2.0, oxide mining cost of US$0.85/t material moved, nine-year mine life.

• SXEW operating cost of US$4.24/t ore.

• Rapid path to production ramping up to 20ktpa cathode through adding on modular plant.

Scenario 2: Combined Operation (28Mtpa) with staged development of open-pit (Figure 4b) approach geared to open access to sulphide as quickly as possible with initial capital requirement of US$1.43B;

• Strip ratio of 0.74, mining operating cost of US$1.42/t material moved, 20-year mine life with maximum annual movement of 170Mtpa.

• Mill operating cost of US$7.05/t ore.

• Combined oxide and sulfide processing with oxide production dovetailed in to be operational whilst mill is constructed.

Scenario 3: Combined Operation (40Mtpa) ramp up in economy of scale of open pit to generate maximum value.

• Strip ratio of 0.62, mining operating cost of US$1.15/t material moved, 23.8-year mine life with maximum annual movement of 230Mtpa.

• Mill operating cost of $5.69/t ore

• Initial capital requirement of US$1.85B

• Maximum copper cathode capacity at 50,000tpa. All production optimized for economy of scale.

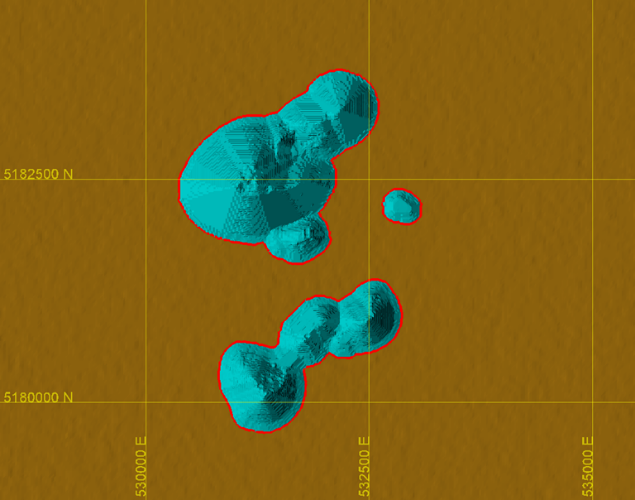

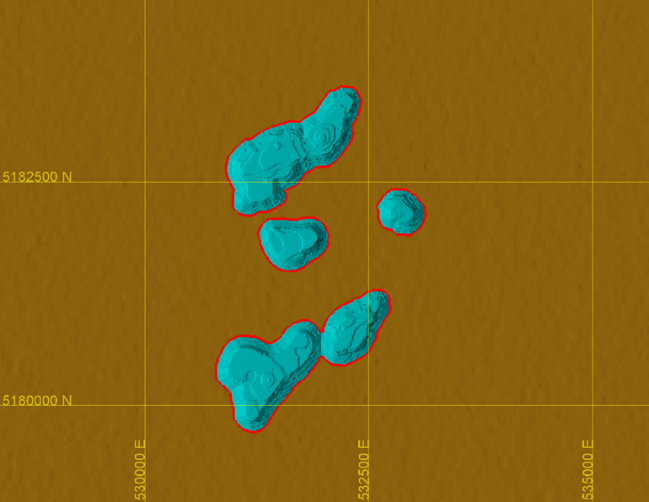

Figure 4 a: Oxide Only Whittle Pit Outline

b: Oxide + Sulfide 28 MTPY Whittle Pit Outline

The grid squares on the plan views represent 2.5km x 2.5km

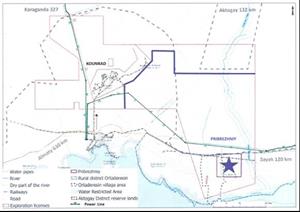

INFRASTRUCTURE ADVANTAGES

The Project benefits from exceptional existing infrastructure (Figure 5) including:

• Access directly from the deposit to the Balkhash-Alashankou Railway with connection to China.

• Grid power already established on the doorstep with capacity to supply a 125MW operation.

• Abundant water supply from the Tokrau aquifer to support 90,000m³/day plant capacity.

• Proximity to Balkhash concentrator and smelter complex with direct railway links.

• Skilled local workforce available based within commutable distances.

Figure 5: Pribrezhniy Infrastructure

FINANCIAL MODELLING RESULTS

The Pribrezhniy Project has been assessed using a discounted cash flow (DCF) analysis with an 8% discount rate. As a stand-alone the oxide SX/EW demonstrates a positive economic result although it is geared to provide maximum free cash in a shorter space of time as possible to offset against the high initial capital costs for construction of the sulphide concentrator should a decision be taken to defer construction. Figure 4a above demonstrates there are five ‘hotspot’ areas where there is scope to develop a lower capital operation involving staged mining to target high value oxide whilst reducing the amount of waste to be capitalized and will be investigated using tactical preliminary mine designs.

Figure 6: PEA outcomes for the three production scenarios

As well as the costs described for the scenarios above, other key NSR parameters considered for the assessment are:

- Metal recoveries of 95% from sulfide through conventional flotation recovery (>27% Cu in concentrate) and from oxide.

- Low transport costs of US$6.63/dmt to the Balkhash Smelter. Treatment charges on Cu concentrate of US$75/dmt and recovery charges US$0.08/lb based on 96.5% Cu payability.

- Conservative price assumption: $8,600/t Cu

- Metal Extraction Tax rates of 8.55% on copper and 7.00% on molybdenum ore mined.

The combined Project benefits from the increased production capacity of 40Mtpa, resulting in higher NPV8% values and better IRR. Larger-scale production often benefits from economies of scale, leading to potential savings on operating costs such as lower unit costs for labor, energy, and materials. This can make higher production rates economically attractive.

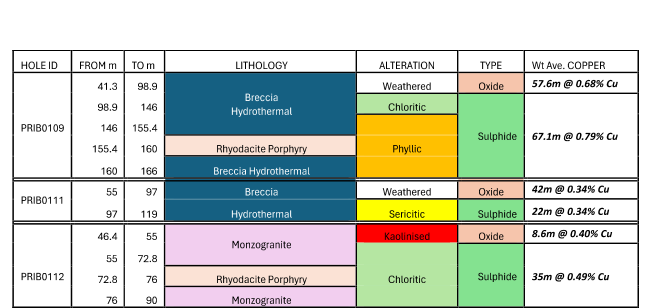

EVALUATION AND EXPLORATION UPSIDE

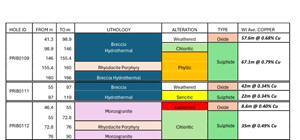

Brecciation forms an important mineralizing event responsible for some of the highest Cu grades. The last drillholes of the 2023 campaign intercepted significant intercepts of ‘auto brecciation’ in a previously untested area with mineralization in both clasts and supporting matrix. A summary of selected high-grade intercepts is shown in Table 1, below. The entire central zone, both oxide and hypogene, warrants close attention to texture and style of brecciation to continue follow up and evaluation of the high-grade occurrence.

Table 1: Selected drill results from the final drill holes of RTEK’s 2023 drilling campaign (refer Figure 2 for collar locations on the deposit).

Recent exploration drilling has identified significant additional potential within the Pribrezhniy license area. Initial reconnaissance drilling completed in Q4 2024 tested two prospective areas along the 40-km long Kounrad-Pribrezhnyy NW-SE trend ("KP Trend"), returning exceptional results including:

• Yuzhnaya Ploshchad Prospect:

- Hole UPL2402: 50m @ 1.16% CuEq, including 15m @ 2.62% Cu, 317ppm Mo & 0.25ppm Au (3.03% CuEq).

- Located 5-10km East of the historic Kounrad Mine.

• Prikounradski II Prospect:

- Hole PKN2405: 181.9m @ 0.31% CuEq, including 62m @ 0.40% CuEq.

- Located 15-20km NW of main Pribrezhniy deposit.

The Company has identified other additional prospects for follow-up exploration:

• NE Kounrad - Historical high-grade intersections 8-12km northwest of Pribrezhniy.

• Shabigon - Historical drilling including 27m @ 0.9% Cu in the licence ‘exclave’ 120km west of Pribrezhniy.

Nine out of twelve reconnaissance holes drilled in Q4 2024 intercepted significant copper mineralization, demonstrating the fertility of the KP Trend for additional copper-molybdenum-gold porphyry systems.

Highlights from other deposits within the Pribrezhniy Licence area (See Jan. 21 press release here.)

NEXT STEPS

The Company plans to advance the Project through:

- Programs totaling 25,000m of resource expansion and definition drilling and Increase value by fully defining the underexplored central brecciated zone with the aim of adding significant oxide and sulphide resources amenable to starter operations. IG’s aim is to define around 50Mt of material >0.5%Cu which would make a significant difference to the cashflow in early years and payback period.

- Rapidly increase grade and tonnage by unlocking the potential of drill ready targets adjacent to Pribrezhniy in the wider Pribrezhniy Licence area and follow up the encouraging results generated at Yuzhnaya Ploschad and Prikounradskiy II deposits.

- Perform detailed metallurgical testing on the oxide material.

- Build on a solid Environmental baseline study and continue real-time studies to develop a detailed Environmental Management Plan.

- Advance to Pre-Feasibility Study. Estimated budget of $5.25M for work program to complete PFS.

MANAGEMENT COMMENTS

Thomas E. Bowens, Executive Director of IG Asia, commented: "The PEA results demonstrate the robust economics of Pribrezhniy across multiple development scenarios. The optionality provided by our oxide resource allows for a potential fast-track development path with modest capital requirements, while the larger combined scenarios show the true world-class potential of this asset. Our location in Kazakhstan's premier copper belt, coupled with exceptional infrastructure and our experienced team, positions Pribrezhniy as one of the most promising copper development projects globally. The recent discoveries at Yuzhnaya Ploshchad and Prikounradskiy II demonstrate the tremendous exploration upside potential beyond our already significant resource base."

TECHNICAL REPORT AVAILABILITY

The complete PEA Technical Report will be available upon request and execution of a Non-Disclosure Agreement (NDA). Interested parties should contact IG Asia directly to request access to the full report.

QUALIFIED PERSON

Steven J. McRobbie, BSc (Hons), MSc, MAusIMM (#224976), Vice President Project Development of IG Asia LLC and a “qualified person” under the definition by the CIM (2014) for National Instrument reporting has prepared, reviewed and validated the technical information in this news release. The PEA was prepared under the supervision of Sam J. Shoemaker Jr., Principal Mining Engineer of J T Boyd Company, who is a Qualified Person as defined by CIM (2014) for National Instrument 43-101 reporting. Mr. McRobbie was an Expert contributor to the PEA and responsible for management of the Project.

ABOUT IG ASIA LLC

IG Asia LLC is a private Nevis-based company focused on the development of the Pribrezhniy Copper Project in Kazakhstan. The Company holds a 75% interest in the Project through a joint venture with JSC Tau-Ken Samruk in the LicenceCo (Balkhash-Saryshagan LLP).

For further information, please contact:

Stephanie Ashton, VP of Business Development: sashton@igglobalgroup.com

Steve McRobbie, VP of Project Development: smcrobbie@igglobalgroup.com

For more information see the company’s website: https://igasia.co/

FORWARD-LOOKING INFORMATION

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management's expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company's forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/57eacc19-9103-4795-a1c4-785b857f2a23

https://www.globenewswire.com/NewsRoom/AttachmentNg/646a1c33-a374-4211-9320-837eb595dbce

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a00495a-ac54-4745-87d3-369511bc6ab9

https://www.globenewswire.com/NewsRoom/AttachmentNg/950b8965-8875-41f5-895a-fa86bb43ded3

https://www.globenewswire.com/NewsRoom/AttachmentNg/e4334856-5930-46cb-b2c6-50b4be93e189

https://www.globenewswire.com/NewsRoom/AttachmentNg/b4cdc0d9-a327-4efc-94e0-5e486a9a8f4d

https://www.globenewswire.com/NewsRoom/AttachmentNg/e5aaa4ca-f0c6-401d-a951-1a7a7d4950ad

https://www.globenewswire.com/NewsRoom/AttachmentNg/dbc7dbfd-78f7-4a5d-b16d-d0c8e2f57624

Figure 2

Property-scale geology of Pribrezhniy with latest diamond drillholes at the end of yearly campaigns for 2022 (blue) 2023 (red donuts).

Figure 3

Drillhole PRIB106, 168m depth. Quartz-chalcopyrite D-type vein with sericite selvage in wallrock cutting rejuvenated A-veins with K-feldspar in granodiorite.

Figure 4a

Oxide Only Whittle Pit Outline

Figure 4b

Oxide + Sulfide 28 MTPY Whittle Pit Outline

Figure 5

Pribrezhniy Infrastructure

Figure 6

PEA outcomes for the three production scenarios

Figure 8

Highlights from other deposits within the Pribrezhniy Licence area (refer to PR: IGG-PR-IGASIA-PRIBREZHNIY-2025_01_21_EXPLO_Final.pdf for further details)

Figure 1

Large porphyry copper ±Mo/Au occurrences along the Balkhash-Ille Arc

Distribution channels: Media, Advertising & PR, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release